The new report looks ahead to a post-pandemic 2021 with pharma manufacturing capacity and payment structures shifting as new sourcing strategies emerge

Amsterdam: A new report from CPhI explores the potential implications in 2021 of impending vaccine approvals, a new administration in the White House and a return to dual supply chain strategies.

The report – which summarises expert analysis into 12 key findings – foresees a particularly positive outlook for the pharma manufacturing supply chain, as a result of the demand for increased second source contingencies, alongside the huge scale-up of vaccine capacity currently underway. A consequence of which is likely to encourage expansion across the contract services sector for all product classes and therapy areas.

Interestingly, the CPhI report highlights that ‘forgotten priorities’ of recent years like AMR (anti-microbial resistance), and continuous manufacturing will return – with the latter potentially simulating new manufacturing approaches for novel applications like RNA technologies.

For example, two of the new COVID vaccines approaching approval use RNA technologies and, while the drive to get these out quickly will mitigate their use in the short term, we may see continuous technologies adopted post approval. “Continuous or intensified processes are in early feasibility stages currently, with investments in research being provided by CEPI and the Gates Foundation,” commented Bikash Chatterjee, Chief Executive Officer of Pharmatech Associates. “Most likely, with the continuation of the pandemic and the extremely high demand for vaccines, we could see a push to incorporate these processes post approval.”

In the most immediate trend predicted, the report highlights that the likely initial stage of global vaccines roll-out will see some degree of ‘vaccine nationalism’ – with the first doses kept for home markets – before scale-up is achieved and global availability frees-up towards the summer of 2021.

“Initial demand for COVID-19 vaccines is going to be global, simultaneous, and will vastly outstrip supply, requiring careful management of this scarce resource. But it’s understandable there will be some degree of nationalism as countries try to secure vaccines for their domestic population first,” commented Dr Mike Whelan, Project Leader at Coalition for Epidemic Preparedness Innovations (CEPI).

The report’s experts suggest pointedly that enough capacity is available to complete over four billion dose of vaccines, so long as it is allocated appropriately, with approved drugs given preferential access to available capacity.

The mass rollout of vaccines was also highlighted as a highly positive development for CDMOs, with increased production needed not just in vaccines, but in all areas so that pharma companies can potentially concentrate on scale-up. In another boon to the supply chain, the shift towards dual sourcing and integrity is leading to more strategic partnerships and ‘capacity reservations’. Peter Bigelow, President of xCell Strategic Consulting and Chairman of the Pharma&Biopharma Outsourcing Association (PBOA), predicted that “CDMO’s are likely to benefit from capacity reservation – with strategic customers and governments looking to maintain available capacity in case it is needed”. As a consequence, this will shrink the pool of available capacity, but also spur increased capacity building by CDMOs. Potentially this means some short-term capacity constraints particularly for smaller biotechs with earlier stage products, but longer term (2022 onwards), an increased availability of resources – potentially helping to exopodite innovation timelines over the next five years.

Unlike the last 12-months, 2021 will see debate shift towards ‘dual sourcing’ strategies rather than ‘reshoring’ approaches. The end of 2020 brought a new presidency and robust late-stage COVID vaccine trial results, which has reduced the urgency to overhaul complex global supply chains. Instead, the report points to a more nuanced approach with investments globally in clean and innovative technologies for reshoring – interestingly, these are not limited to the USA and Europe, as is often widely assumed, with China also expected to adopt these and potentially at an even faster rate – and dual, tactical and geo sourcing taking precedence. The latter is used to potentially mitigate risks by having a second reserve supplier (e.g. API manufacturer or CDMO) in an alternative country in case of disruption with the primary manufacturer.

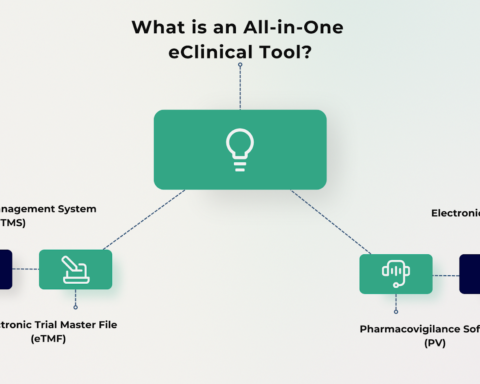

Significantly, the digitisation of API sourcing is likely to accelerate with many companies seeing step change improvements in business costs, with digital, real-time and virtual auditing to continue to advance both in scale and capability quickly.

Finally, Gil Roth President of the Pharma & Biopharma Outsourcing Association envisages new payment models for therapies creating new contract structures for CDMOs. “Innovations like cell and gene therapies which accrue a front-loading of the patient population, with many patients treated upon launch, and diminishing volumes required over time as fewer patients remain to be treated will mean such a model for CDMO as well. Contracts will need to shift from ongoing volumes typically treated in contract relationships to much larger upfront payments”.

Gareth Carpenter, Pharma Editor at Informa Markets commented, “This report highlights not only the very real challenges the pharma manufacturing and supply chain sector faces in 2021, but also the opportunities it is leveraging. If, as expected, vaccines do help overcome the COVID-19 pandemic, the pharma industry will make significant reputational gains. One thing that is clear is that more manufacturing of advanced drugs will take place next year at an unprecedented scale, and CPhI will do all we can to support the industry in forging new partnerships both digitally and in person by providing it with platforms to meet and do business.”

To download a copy of the 2021 CPhI Pharma Trends report, click here.